Are you moving to Spain but are unsure what the best Spanish bank is for you? Are you wondering how to open a bank account in general, especially as a non-resident? Opening a bank account in Spain might seem complicated but we promise you it is not that much of a hassle.

When it comes to opening a bank account in Spain there are several great options available to you but it is not so easy to actually find them.

This comprehensive article was created as a guide to banking in Spain with the goal of helping you choose the best bank in Spain that meets your expectations and preferences. In this article we will not only cover all the important aspects behind opening a Spanish bank account as a non-resident, but also our top recommended banks, international money transfers, money saving tips and more.

So please continue reading to learn everything there is to know!

- 1. Things to Keep in Mind Before Choosing a Spanish Bank

- 2. How to Open a Bank Account in Spain as a Non-Resident

- 3. Best Banks in Spain for Non-Residents & Best Options for International Students & Expats

- 4. Bank Fees & ATM withdrawals in Spain & Europe

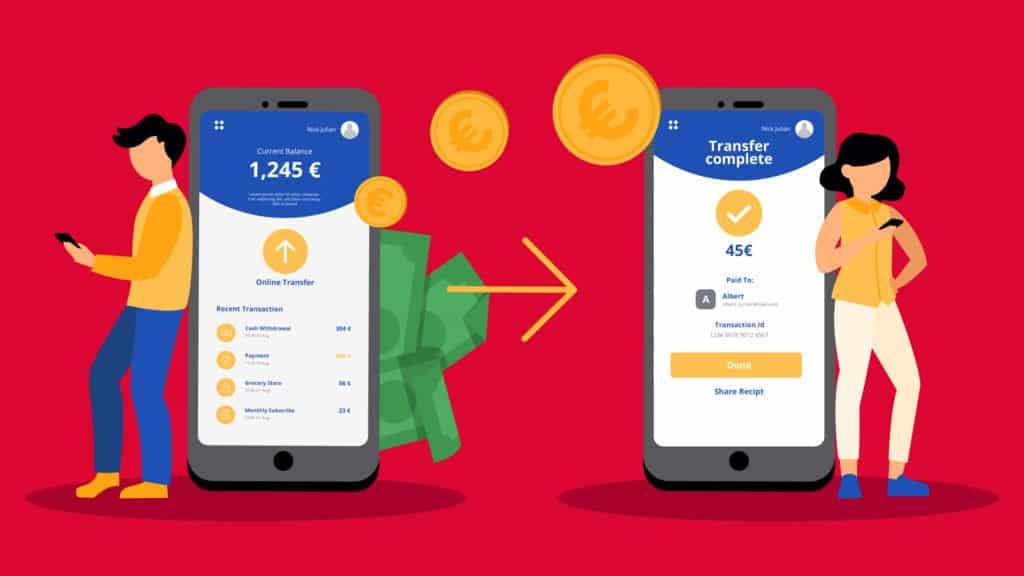

- 5. International Money Transfers – Don’t Waste your Money

- 6. Lost or Stolen Bank Cards in Spain – What to do

- 7. Online Banking Form for Quick & Easy Application with Banco Sabadell

- 8. FAQs

1. Things to Keep in Mind Before Choosing a Spanish Bank

Before we talk about which banks are the best for you and how to actually open a bank account in Spain, there are a few things you should consider about banking in Spain in general. With this information you can move forward with the right objective in mind and make a well informed decision.

Deciding if you Truly Need a Spanish Bank Account

If this is your first time living in Spain for a longer period of time, the first question you need to ask yourself is if you really need to open a Spanish bank account. If you are coming to work, then you will definitely need one to receive your salary. However, if you are an international student who is only staying for a few months you might not necessarily need one. That being said, Non-EU citizens will always save costs by opening a Spanish bank account, as they won’t have to deal with all the fees that come with using a foreign card abroad.

Avoiding Unnecessary Costs Associated to your Spanish Bank Account

Nothing is worse than losing money to the bank that is keeping your money safe. That’s why it’s important to be aware of all potential fees you might incur when comparing your banking options. To help you save time on this topic, we’ve ensured to base our recommendations on our years of experience as well as on the feedback from thousands of young internationals that we’ve welcomed to the city over the years.

If you’re not careful, costs related to your bank account can quickly accumulate, especially as some things here in Spain work differently from what you’re used to back home. This puts even more pressure on your search for the right bank. Luckily, with our top recommendations we hope to contribute our share so that you will skip annoying “hidden costs” like monthly maintenance fees, ATM charges and costs related to international bank transfers, especially to outside the European Union.

Tip 1

When you open a bank account in Spain, you will most likely receive both a debit and a credit card. You can use these cards to withdraw money from your bank’s ATM machines for free. However, remember it is likely that you will be charged a fee to withdraw money at ATMs from other banks in Spain and Europe. Wise, bunq & Revolut are 3 amazing online banks that offer free, limited withdrawals – even from abroad. In addition to an easy sign-up process online, cheap international money transfers, international debit card that you can use worldwide with minimal fees and much more.

Tip 2

Standard bank transfers within the European Union (EU) are always free of charge, but bank transfers to/from outside the EU are very costly and can be avoided by using money transfer services like Wise, bunq and Revolut, which uses Wise’s transfer technology.

Wise has become a very popular and cheap option for transferring money between bank accounts to/from Spain. But also bunq and Revolut are great options. Skip ahead to read more about international money transfers.

2. How to Open a Bank Account in Spain as a Non-Resident

You can open a bank account with most banks in Spain once you arrive in the country, but not before. If you do not have your foreigner’s ID card (NIE/TIE) at the time of your application for the account, then you will need to open your bank account as a non-resident. This is not a problem with our three top recommended banks (see below), so do not worry. Just remember that you should switch your non-resident bank account to a resident bank account once you do have your NIE/TIE. The process is very easy, all you need to do is present your NIE/TIE card to your bank. If you do not have to apply for a NIE/TIE – perhaps because you are staying less than 6 months – then simply make sure to cancel your bank account before leaving Spain at the end of your stay.

To jump straight to our three top recommended Spanish banks to open an account with, click the button below.

What Documents do you Typically Need to Open a Spanish Bank Account?

When opening your bank account in Spain you will need the following documents/information*:

- A valid passport or national identity card

- Your reason for opening an account (documentation is not always required but it is recommended to bring, for example, the letter of acceptance of your university in Spain or a copy of your Spanish work contract)

- Indication of your address in Spain. If you do not have a Spanish address just yet, you will be able to hand in this information later on. Some banks will also ask for your TIN, so it might make sense to have it at hand too

- To open a bank account as a resident, you will need your NIE/TIE number at hand

*Please note, the list above might vary depending on the bank you choose. Some nationalities will be asked to deliver more documentation than others according to the laws here in Spain.

Please keep in mind that opening a bank account in Spain with traditional banks will require you, in most cases, to physically visit the bank to sign a contract. Your bank account will be not be officially opened nor your cards sent to you until you sign the contract. This process can be quite slow in comparison to other countries. While your bank account will become active right away, you cards may need between 1 to 2 weeks to be delivered.

Opening a Bank Account at an Online Bank in Spain

While traditional banks with physical locations are still the most popular form of banking, online banking in Spain is quickly becoming a very popular choice for managing funds. Online banks tend to offer many of their services for free or at a very low cost. This in addition to the ease of managing everything online make them a very desirable option – especially for young internationals. However, to open a Spanish bank account with an online bank, you will also need to wait till you arrive to Spain! Our top recommendations are Wise, bunq and Revolut. All three can actually get you a proper Spanish IBAN (account number) if you have your NIE/TIE or a Spanish ID. Click the links to learn more about Wise, bunq and Revolut.

3. Best Banks in Spain for Non-Residents & Best Options for International Students & Expats

Below you will find an extensive outline of our research on the best banks for expats and international students in Spain for 2025. The Spanish banking system is fully integrated with the international financial market and there are a variety of banks to choose from – like private, state-owned banks as well as international and online banks. These banks are regulated by the central banking authority here in Spain, also known as the Banco de España, which is located right in the center Madrid.

To help you select the bank that is best for you, simply keep reading. The summary below will help you choose the best bank account that meets your needs.

Important: The Citylife team has collected & compiled the information on this page via intense research and investigation. It does not replace your own research!

Our top recommendations are based on the following criteria that we believe are essential to young internationals:

- Low to zero fees

- Convenience

- Free money withdrawal

- Free money transfers

- High service quality

- Internationality

Citylife’s Top Picks for Best Banks in Spain 2025

Every year at Citylife we speak to different banks around the city to learn about potential new services and updates. Based on these talks and our yearly survey, we have selected the three best banks that we feel will benefit our community the most and work closely with them throughout the year. Our focus lies on an easy opening process, the lowest costs, great user experience as well as good service quality and service in different languages. We usually select a traditional bank as well as a modern online bank.

Our three favourite banks in Spain for 2025 are: Banco Sabadell (traditional bank account), Wise, bunq and Revolut.

Banco Sabadell

Top traditional bank in Spain for internationals

- Free transfers within the EU

- Free ATM withdrawals in Spain

- Service in Spanish & English

- Free debit/credit card with application

- Easy & quick process to open an account without NIE/TIE

- Reliable and modern online service

- Free account if you are under 30 years of age

- Several different accounts to choose from

- Very known bank with great reputation

Wise

The world’s most dynamic international bank

- Worldwide transfers at low exchange rates

- Free ATM withdrawals of up to 200€/month

- Free debit card with application

- Service in over 10 languages

- International transfers to over 30 countries at real exchange rates (no bank fees)

- No physical location

- Access to local bank details in over 10 currencies (USD, CAD, EUR, GBP & more)

- Open multiple balances for different currencies within one account

bunq

International Student Bank in Spain

- Spanish IBAN with account

- Free transfer within EU and worldwide transfers at low rates

- 6 Free ATM withdrawals every month

- No NIE/TIE required for the first 90 days

- Service in over 35 languages

- High interest on savings

- 3 free physical cards

- Open an account in 22 different currencies

- Great exchange rates

Revolut

Popular online bank in Spain

- Free transfers around Europe, America and Australia

- Free ATM withdrawals of up to 200€/month

- Free debit card with application

- Service in Spanish & English

- Integrated Interbank Exchange Rates for international transfers

- No physical location

- Built in expense manager & budget support

- Access to cryptocurrency

- Single use cards

N26

Completely virtual international Bank

- Spanish IBAN with account

- Free transfer within EU and worldwide transfers at low rates

- 3 Free ATM withdrawals every month

- Free virtual Mastercard debit card (Google/Apple wallets)

- Service in over 10 languages

- Integrated Wise transfer technology within app

- No physical location

- Built in expense manager & budget support

- Several different accounts to choose from

More Banking Alternatives in Spain

Aside from our three favourite banks for expats and international students that we’ve already mentioned, below you will find a list of further traditional and online banks in Spain. Some of the banks mentioned below are Spanish online banks with no physical locations, while others are traditional Spanish banks, that also offer full online banking service options.

Important: Not all of them will allow you to open a Spanish bank account as a non-resident! Additionally, the process of opening a bank account might require more paperwork and Spanish language knowledge. This is just another reason why we recommend Banco Sabadell, as they offer an easy process and support in English.

Banco Santander

Traditional bank in Spain

- Free transfers within the EU

- Free ATM withdrawals at Santander ATMs worldwide

- Free debit card with application

- Several different accounts to choose from

- Very known bank with great reputation

- Personal expense manager

Bankia

Traditional bank in Spain

- Service in Spanish & English

- Free debit/credit card with application

- Free ATM withdrawals at Bankia ATMs around Spain

- Free account if you are under 25 years of age

- Several different accounts to choose from

- Very known bank with great reputation

- Many locations all over Spain

Evo Bank

Traditional but modern bank in Spain

- Free transfers within the EU

- Free withdrawals at ATMs around the world

- Free debit card with application

- Easy & quick process to open an account

- Free account if you are under 25 years of age

- Several different accounts to choose from

- Very known bank with great reputation

Additional Spanish & international banks that are also worth checking out:

The list of banks in Spain is very long. To see an overview of all banks operating in Spain, simply click here.

4. Bank Fees & ATM withdrawals in Spain & Europe

Banking will always come with certain fees, this is just a fact. But there are ways that you can avoid these fees. It’s important to ensure you are as informed as possible, so once you arrive to Spain you can spend your money wisely. Continue reading for some essential tips on avoiding fees when using your credit/debit cards at ATMs as well as during basic transactions.

When Using your Spanish Bank Card in Spain & Europe

On average, bank accounts in Spain can incur fees that can range from very little to quite a bit (up to around 150€) per year. As we’ve already described in detail above, some banks offer deals as well as cheaper bank accounts for certain groups like students or depending on your age. Additionally, banking costs can vary depending on each institution, so we always recommend that you ask for this information upfront and review their list of fees before opening any account. Especially if this information is not already provided by the bank outright.

Besides the general fees, make sure to look out for potential costs regarding things like debit and credit card transactions, international bank transfers (especially to outside the EU) and ATM withdrawals in Spain & Europe in case you plan on traveling.

We also recommend that you check on possible daily withdrawal limits, as this is something that may affect the usage of your account. Another thing to keep in mind when it comes to withdrawals is that you will always be able to take money from your own bank’s ATM machines for free, however if you need to withdraw money from a different bank’s machine you might be charged an additional service fee from that bank.

When Using your Foreign Bank Card in Spain & Europe

At some point during your time abroad we are sure that you will end up using your foreign credit/debit card (aka a card from your bank back home). If this is the case, there are a few but very important things that you need to keep in mind in order to avoid complications, as well as paying a fortune in fees for foreign transactions and currency conversions.

The first thing to do is to notify your bank (before you leave your country) that you will be living in Spain for a while. By doing this your bank will know that it is you using your card during your trip. Therefore they will not block your card for suspicious activity. They do this to protect your money, but it can be a time consuming hassle to unblock your account again, especially from abroad.

The next thing to do is to ask your bank if they have any partner banks here in Spain were you can save money on ATM withdrawals with your foreign card. If so, then you can plan to take money out at those banks. However, you will still be charged fees for the currency conversion and the transaction itself. The amount will just be reduced.

Overall, you can see by our comparison that in many cases it is much cheaper to simply use a Spanish bank account during your time in Spain. With a Spanish account you will not need to worry about any form of currency conversion (even when traveling Europe) and you will have quick and easy access to your money.

5. International Money Transfers – Don’t Waste your Money

There is no doubt that at some point during your time abroad you will need to transfer money either to or from your account. Whether it’s sending money from your home account, in bulk, to your new Spanish bank account or simply sending money to friends to pay them back for covering the bill at a restaurant. Whatever it may be, you will definitely have to send at least one transfer and there are several things you need to consider when you finally do so. Continue reading to make sure you transfer your money wisely.

International Money Transfers (Outside the EU)

Sending money to/from Spain to/from an account outside the European Union can be inconvenient and costly. But if you have no other choice, there are great alternative options to traditional bank transfers that will save both money and time.

Your first thought might be to simply send a bank transfer, however, this is usually a more expensive option. Banks will often charge several fees to cover the transfer, including a fee to send the money, to receive the money and also, to convert the currency. We recommend that you always ask both the sending bank and the receiving bank about their fees for international transfers so you are prepared for the costs that will come. The time frame for these transfers to be completed is up to 5 working days.

Besides the the two already described popular apps to transfer money abroad, Wise, bunq and Revolut, there are some other platforms and services that you can use to transfer your money internationally. Some of these include MoneyGram and Western Union, however these services also tend to charge at higher rates.

Currently, one of the cheapest, transparent and most popular options for international money transfers is Wise. This is an easy to use website / application that allows for not only cheap international money transfers from account to account, but also immediate transfers from card to card!

Transferring Money within the EU

When it comes to transferring money between Spanish accounts, and even accounts from countries within the EU, you do not need to worry about paying any fees. However, it’s important to take this information on a case by case basis, as the urgency of a transfer or other varying conditions may result in some type of fee. But, as a general rule international money transfers within the European Union are free of charge. The time frame for these types of transfers can range between 1-3 working days.

6. Lost or Stolen Bank Cards in Spain – What to do

If your bank or credit card is lost or stolen in Spain, you should immediately contact your bank or card provider to cancel the card. In most cases there will be a 24-hour customer attention hotline that you can call. Make sure to ask for this number when opening your account. The next thing to do is to report your card stolen at the nearest police station.

7. Online Banking Form for Quick & Easy Application with Banco Sabadell

To make the process of opening a free Spanish bank account as easy as possible, Citylife Madrid has teamed up with Banco Sabadell! They are offering a very easy and quick way to open a bank account in Spain as a non-resident. Their services are available in Spanish and English as well as online, so you can initiate the opening of your account even before traveling to Madrid!

To start the process of opening your free bank account now, simply fill out the form below. Please attach a copy of your Passport/ID. We will immediately forward your request and put you in touch with the international department at Banco Sabadell. We will also provide further instructions in the e-mail.

Please note, filling out the form below does not mean that you have to activate the account and also does not cost you anything! If you realize at any point after submitting the form below that you do not need a free Spanish bank account anymore, do not worry, simply answer on the mail you will receive by the bank.

2 Comments. Leave new

Hi. What do I fill for “Are you a resident of Spain?”

I have a residency permit but not a citizen of Spain. I will get my residency card only after I arrive in Spain

I am trying to apply for an account

every time I put the date on the application

it send a message it is wrong

14.11.2001 for example for Sept 14 , 2001 this is what I wrote